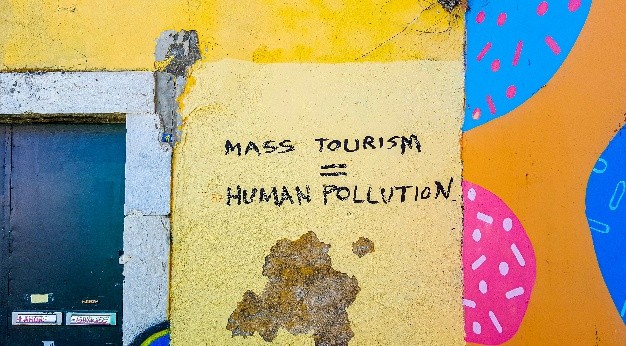

Popular holiday destinations have increasingly been using tourism taxes. In 2019, 9 of 28 EU countries used such taxation. Destinations typically use tourist taxes to prevent over tourism for either environmental or social reasons like reducing overcrowding.

In April 2024, Venice started to use a tourist tax. And it was recently announced that next year, Venice’s tourist tax for day trippers will be in place for an extra 6 days. The taxes raised €5,421,425 in 2025. But the measure has reported to be ineffective at reducing overtourism.

The trouble with embracing tourism taxes

This poses the question: why aren’t tourist taxes reducing overtourism? The obvious answer might be that the tax isn’t high enough. Or that it isn’t applicable to the right time frame. But there’s a less obvious reason. And that is:

Perhaps a tourist tax makes a location more attractive to travellers?

Yes, this sounds counterintuitive. But there’s evidence to suggest that this is true. So why ask this question now?

Because tourist hotspots like London and the Canaries are considering adopting tourism taxes in the near future. And just yesterday (29th September, 2025) the Dutch village of Zaanse Schans – with a population of 100 people – announced that it’ll be introducing a €17.50 tourist tax to reduce its 2.6 million visits.

So, let’s unpack the issue to see why tourist taxes are perhaps changing behaviour in the opposite direction to which they’re intended.

Taxing moments

We know travellers invest time in researching destinations. So, it’s likely they’ll know a potential holiday destination applies a tourist tax. So, when they see this information, how could they interpret it?

1. A sign of proficiency

Travellers can perceive a tourist tax to be a sign that a location is well managed by the local authorities. This is because price is a sign of quality. This is why people think cheap wine tastes nice if they’re told it’s expensive. But in the context of a location, price signals the qualities of being a well governed and thoughtful tourist destination.

2. A sign of popularity

If travellers dig into why a location charges a tourist tax, they’ll quickly learn that it’s due to overtourism. This immediately signals somewhere is popular. And therefore, worth visiting. This is known as social proof. Social proof is the idea that if something – or somewhere – is popular, it becomes more appealing. And is most visible in travel by the prominence of reviews and ratings.

3. A sign of scarcity

A tourist tax implies that a destination has a limit on how many tourists it wants there. This implies that a destination has a degree of scarcity about it. And scarcity sells. Look no further than Starbuck’s pumpkin spiced latte. The drink is only available for a limited time. This scarcity caused its popularity to surge during the 2010’s.

In travel the use of scarcity is visible on any OTA website which communicates “only X rooms remaining”. Is the tourism tax now taking this principle offline?

4. Setting expectations of excellence

When travellers that see a potential destination has a tourist tax it suggests three things that can make it more attractive to them:

- The destination cares about the experience it offers. After all, who wants to go to a crowded destination?

- The destination is worth protecting. Why else would you have to pay to go there?

- Transparency. A destination is communicating you’ll be taxed as a tourist in advance. Transparency drives trust. And we’re all risk averse, which makes trust an important travel criteria

5. Paying tax to feel good

People like to feel they’re part of something. Especially when the something is for a good cause. This means that paying tourist taxes makes travellers feel like they have helped a destination as part of their travels.

According to research by Amadeus, 18% of travellers say being sustainably responsible is important to them. Which in turn means that destinations where people can pay to balance out for the environmental impact will appeal to sustainably minded travellers. This will likely be an even greater factor in collective cultures that focus on society as a group.

What does this mean for booking travel agents?

For travel agents, the psychology behind tourism taxes means they have a chance to help reduce overtourism in the way they guide traveller’s choices.

There are three ways travel agents could do so:

1. Promote alternative destinations

If travellers are drawn to a hotspot with a tourist tax, travel agents can suggest nearby or lesser-known places that offer similar experiences without the crowds. This way, travellers still feel they’re accessing something special, but without adding to overtourism.

2. Encourage off-peak travel

Travel agents can position shoulder-season or mid-week travel as a way to enjoy the same destination with fewer people and often lower costs. Many taxes are applied during peak days, so timing can make a big difference.

3. Direct eco-conscious travellers elsewhere

For eco-conscious travellers, travel agents can highlight that how tourist taxes are adding to overtourism and then provide them this with eco-certified hotels or carbon offsetting as a way to travel responsibly.